COVID 19 Impact on Global Ride-Hailing Market Future: Ken Research

Major players in the ride-hailing market are Uber Technologies Inc., Grab, ANI Technologies Pvt. Ltd., Gett Inc., Lyft Inc., DiDi Chuxing, Delphi Automotive, Daimler AG., BlaBlaCar, and Didi Chuxing Technology Co.

The global

ride-hailing market is expected to decline from USD 60.5 billion in

2019 and to USD 52.07 billion in 2020 at a compound annual growth rate (CAGR)

of -13.88%. The decline is mainly due to the COVID-19 outbreak, extending

lockdown across countries, and the measures to contain it. The market is then

expected to recover and reach USD 85.48 billion in 2023 at a CAGR of 17.97%.

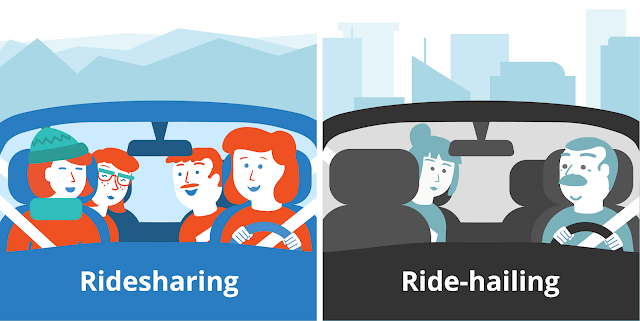

The ride-hailing market consists of revenue generated by ride-hailing used for passenger transportation service in which the passengers are connected with the vehicle drivers through a smartphone-based app. The industry comprises establishments primarily engaged in providing passenger transportation by automobile or van, not operated over regular routes and on regular schedules. Establishments of taxicab owners/operators, taxicab fleet operators, or taxicab organizations are included in this industry.

North America was the largest region in the

Ride-hailing market in 2019. Asia Pacific is expected to be the fastest-growing

region in the forecast period.

Ride-hailing services have been advancing in the past few years by delivering

innovative facilities to riders all over the world. Using a ride-hailing app on

an Android device has now become very common. For instance, Uber is a ride-hailing

app from which we can request a women driver. This feature is mainly

implemented to focus on the safety of a woman which helps to stay protected

with a verified profile of a woman driver before committing the journey. A

major initiative is promoted by Safr, which permits the female passengers to

select the gender of the driver, offers complete details about the driver's

training. Similarly, HopSkipDrive is another ride-hailing app that gives safe

and smarter transportation solutions to children by employing professional care

drivers who have a minimum of 5year experience in caregiving.

The ride-hailing market covered in this

report is segmented by vehicle type into two-wheeler, three-wheeler,

four-wheeler, others. It is also segmented by end-user into commercial,

personal, and by service type into e-hailing, car sharing, station-based

mobility, car rental.

Ride-hailing service providers need to follow

several state and central laws for uninterrupted services. For instance, in the

U.S, driver-related regulations include requirements for background checks,

driver's licenses, vehicle registrations, special licenses such as business

licenses, and external vehicle displays. While, the company-related regulations

include requirements for the number of ride-hailing vehicles operating in a

metropolitan area, providing a list of drivers to the city, and sharing trip

data with the city. In some countries, fingerprint-based background checks are

mandatory. This is because of the reported incidents of sexual assault and

violence. In February 2020, a report from the Union of Concerned Scientists

shows that the average U.S. ride-hailing trip results in 69% more pollution

than the transportation choices it displaces, based on federal vehicle

efficiency statistics. The environmental concern has enforced certain

regulations on pollution control. Therefore, more restrict regulations are

coming into force, and compliance with these government regulations may act as

a restraining factor to the ride-hailing service market growth.

In March 2019, Uber is an American

multinational ride-hailing company that acquired Careem for USD 3.1 billion

amount. This provides an opportunity for both companies to rapidly expand and

capitalize on the region's underpenetrated mobility opportunity and the growing

digital economy. The transaction would be the largest-ever technology industry

transaction in the greater Middle East region. Careem is the internet platform

for the greater Middle East region. A pioneer of the region's ride-hailing

economy, Careem is expanding services across its platform to include mass

transportation, delivery, and payments.

On-demand transportation services and a lower

rate of car ownership among millennials are driving the growth of the

ride-hailing market. On-demand transportation services are characterized by

flexible routing and ad-hoc scheduling of private vehicles offering personal

transport experience to the general public by picking or dropping at locations

of passenger's choice. On-demand ride-hailing services ensure that customers

can accurately locate the vehicles, track their journey, and offer safety to

the occupants, and this factor is expected to significantly drive the market

growth. Additionally, a lower rate of car ownership among millennials due to

the high maintenance cost of personal cars is resulting in the rise in demand

for ride-hailing services. The millennials are choosing practical, smartphone

accessible transport options that are simple, flexible, and inexpensive over

car ownership. Also, buying a new car and maintaining it is costlier than

renting a vehicle every year. Thus, gradual penetration of such car ownership

(car rentals) is estimated to fuel its demand across the globe in the coming

years. Hence, on-demand transportation services and a lower rate of car

ownership among millennials drive the growth of the ride-hailing market.

For More Information on the

Research Report, refer to below links: -

COVID

19 Impact on Global Ride-Hailing Market

Related Report: –

Contact Us: –

Ken Research

Ankur Gupta, Head Marketing &

Communications

+91-9015378249

Comments

Post a Comment